How MAM Trading Works

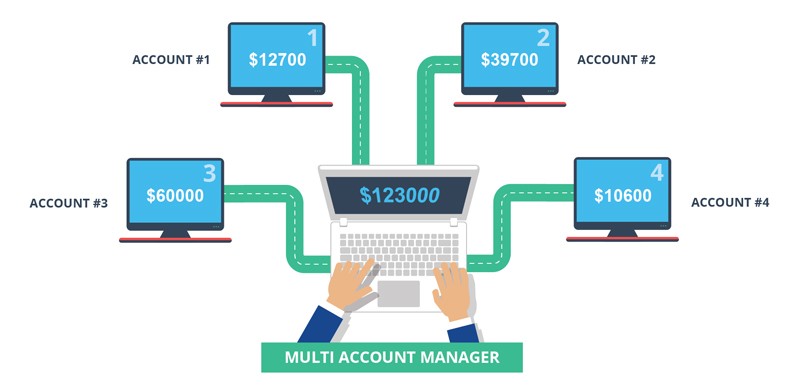

- 1. Setup and Configuration: Once you open a master account with Merkanda Markets Ltd, you can link multiple client accounts to your master account. Configure the allocation methods and trading parameters according to your preferences.

- 2. Executing Trades: Execute trades on the master account, and the MAM system will automatically allocate the trades to the linked client accounts based on the predefined allocation method.

- 3. Monitoring and Management: Use our advanced trading platforms to monitor the performance of all managed accounts in real-time. Adjust strategies and parameters as needed to optimize trading outcomes.

- 4. Reporting and Analytics: Access detailed reports and analytics to track the performance of each account. Use these insights to refine your trading strategies and enhance overall performance.

Explore the versatile and dynamic world of CFDs trading with Merkanda Markets Ltd and leverage our expertise to enhance your trading experience.